San Jose, California – Lam Research, a Wafer Fabrication Equipment (WFE) company based in Silicon Valley, has shown significant growth in recent months. Since October 2023, when a buy recommendation was issued, Lam Research’s stock has surged by approximately 66%, outperforming the S&P 500 index, which has seen a 26% increase during the same period.

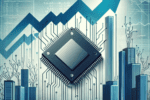

The WFE industry experienced a cyclical downturn in the first half of 2023, with signs of recovery appearing by the end of the year. Projections indicate that WFE spending will accelerate in 2024 and experience a strong rebound in 2025, driven by capacity expansion and high demand for advanced technologies in both front-end and back-end operations.

Recent statements from Micron Technology’s CEO hint at increased capital spending in the coming year, which could lead to revenue growth for Lam Research as Micron is one of its key customers. This anticipated growth in spending aligns with expectations for a robust rebound in WFE memory applications in 2025, particularly in areas like NAND and DRAM.

As we enter the second half of 2024, continued positive news around WFE demand could lead to further stock price increases for Lam Research. With a focus on long-term growth drivers, such as advancements in AI, new chip technologies, and global investments in chip manufacturing capacity, Lam Research is positioned for potential growth over the coming years.

Despite facing risks related to geopolitical tensions and increasing competition in the industry, Lam Research’s strong financial position and strategic partnerships with key customers provide a solid foundation for future success. Investors looking for opportunities in the semiconductor sector may find Lam Research to be a compelling investment option, with the potential for continued growth and innovation in the years ahead.