Dallas, Texas – Builders FirstSource, a leading building materials supplier, has experienced a challenging year amid disappointing first quarter earnings. Despite facing new lows in their stock performance, the company remains profitable and shows potential for value investors.

Analyzing Builders FirstSource’s balance sheet reveals a significant cash reserve of $697 million and total assets of $11.17 billion, outweighing total liabilities of $6.21 billion. With a focus on higher-margin products like trusses, the company aims to improve margins and drive revenue growth in the future.

Builders FirstSource operates in 43 states and serves major customers such as D.R. Horton, Lennar, and Toll Brothers. While the company faces competition in the building product industry, its diversified offerings cater to a wide range of customers, from national builders to local contractors.

However, risks linger for Builders FirstSource, including its dependency on the US economy and credit markets for new home construction. The company also faces challenges from potential shifts in market demands towards smaller houses, which may necessitate adaptation to meet evolving preferences.

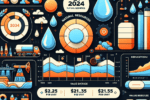

Regarding earnings, Builders FirstSource maintains stable net sales but faces fluctuations in gross margin and net income. Earnings estimates for the upcoming years project minimal growth, with the company trading at a P/E ratio indicative of a value stock. Despite a lack of dividends and a substantial long-term debt, the company’s financial stability remains a key consideration for investors.

In conclusion, Builders FirstSource presents a cautious hold for investors, with potential for further downside in the stock price offset by long-term growth prospects. While the company may become more appealing at lower price levels, investors should carefully assess the remaining risks inherent to the business before making investment decisions.