New York, NY – Amid escalating trade tensions, President Donald Trump has announced plans to impose tariffs on Mexico, Canada, and China, causing a surge in the value of the dollar. The move has sent shockwaves through global markets, with investors and economists alike expressing concerns about the potential impact on international trade relationships.

The decision to implement tariffs on key trading partners has sparked fears of a trade war, with many experts warning of possible retaliation from affected countries. Trump’s pledge to impose tariffs of up to 25% on goods from Canada and Mexico has raised alarms within the business community, leading to uncertainty and unease among stakeholders.

Trump’s tariff threat has particularly rattled Canada, a key ally and trading partner of the United States. The uncertainty surrounding the future of trade agreements between the two countries has cast a shadow over the Canadian economy, with businesses bracing for potential disruptions in the supply chain and increased costs of imported goods.

The announcement of tariffs on three major trading partners has led to increased volatility in the markets, with investors reacting nervously to the news. Trump’s aggressive stance on trade and tariffs has sparked concerns about the potential impact on global economic growth and stability, prompting many to closely monitor the situation for further developments.

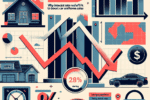

The president’s tariff post has sent shockwaves through financial markets, with experts warning of potential repercussions on industries and consumers. As the trade dispute continues to escalate, analysts are keeping a close eye on the negotiations between the United States and its trading partners, seeking to understand the implications of Trump’s aggressive trade policies on the global economy.