Atlanta, Georgia – Coca-Cola, a global beverage giant, continues to showcase strength and resilience in the market, solidifying its position as a top-tier investment option for stability-seeking investors. With a diverse brand portfolio that boasts names like Fanta, Sprite, and Coca-Cola itself, the company has maintained a dominant presence in over 200 markets worldwide.

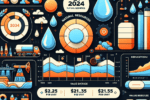

One of Coca-Cola’s key selling points is its consistent growth in key segments, evident in its impressive financial performance in Q1 of 2024. Despite facing challenges like negative foreign exchange fluctuations and organic volume decline in certain regions, Coca-Cola managed to achieve a 3% sales growth compared to the previous year. This growth was primarily driven by the company’s pricing power, strategic product mix, and geographic presence.

In terms of profitability, Coca-Cola has outperformed its competitors like PepsiCo and Keurig Dr Pepper, boasting a gross margin of approximately 62.5% in Q1 2024. Additionally, the company’s Operating Income and EBITDA margins have consistently remained strong, showcasing its ability to generate sustainable profits.

As a ‘Dividend King’, Coca-Cola has a track record of over 50 consecutive dividend increases, offering income-oriented investors a reliable source of returns. The company’s dividends have shown steady growth over the years, further enhancing its attractiveness to shareholders seeking stability and long-term growth potential.

Looking ahead, despite concerns about its valuation compared to peers, Coca-Cola’s strong market position, solid financial performance, and commitment to shareholder value make it a compelling investment opportunity. The company’s forward-looking outlook and strategic initiatives position it well for continued success in the ever-evolving beverage industry. Investors looking for a stable and reliable investment choice may find Coca-Cola to be a promising option for their portfolio.